Two critical areas in the complex business operations landscape stand out: workers’ compensation (workers comp) and payroll management. When handled correctly, these functions can contribute significantly to a company’s success.

However, mismanagement in these areas can lead to financial losses, legal issues, and a disengaged workforce. This article delves into practical strategies for optimizing workers comp and payroll done right processes to ensure success.

Understanding Workers Comp and Payroll:

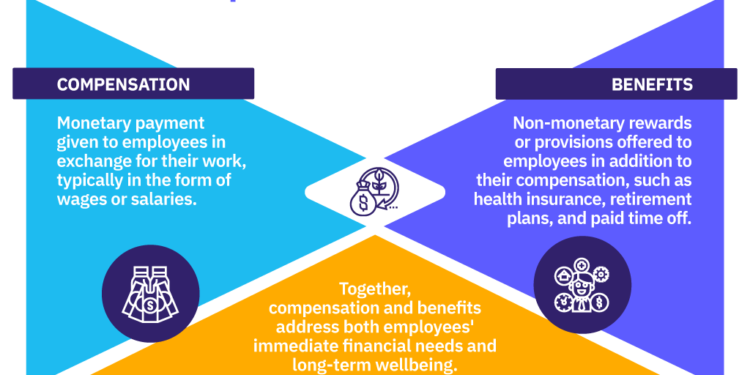

Workers comp is a form of insurance providing wage replacement and medical benefits to employees injured during employment. On the other hand, payroll management involves calculating and distributing employee wages, taxes, and benefits. Both functions are intertwined and crucial for maintaining a healthy work environment and legal compliance.

Some Approaches For Accurate Workers Comp And Payroll:

Here are some approaches you should follow for workers comp and payroll done right.

- Comprehensive Risk Management:

Implementing robust risk management strategies is fundamental to minimizing workplace injuries and subsequent workers comp claims. This includes conducting regular safety audits, providing adequate employee training, and enforcing safety protocols.

By prioritizing workplace safety, businesses can reduce the frequency and severity of accidents, thereby lowering workers comp costs.

- Accurate Classification of Employees:

Properly classifying employees is essential for payroll compliance and workers comp insurance. Misclassification can lead to penalties, legal liabilities, and financial losses.

Businesses must correctly differentiate between full-time employees, part-time employees, independent contractors, and exempt/non-exempt workers to confirm accurate payroll processing and insurance coverage.

- Effective Claims Management:

Prompt and efficient handling of workers comp claims is crucial for minimizing disruptions and maintaining employee satisfaction. Establishing clear procedures for reporting and investigating workplace injuries guarantees timely resolution and appropriate compensation for injured employees.

Additionally, proactive communication with wounded workers fosters trust and demonstrates a commitment to their well-being.

- Compliance with Regulations:

Staying abreast of changing regulations and compliance requirements is paramount for mitigating legal risks associated with workers comp and payroll done right management. Non-compliance can result in hefty fines, litigation, and reputational damage.

To ensure adherence, businesses must regularly review federal, state, and local laws governing workers comp insurance, payroll taxes, minimum wage, overtime, and employee benefits.

- Employee Engagement and Communication:

Engaging employees in the worker’s comp and payroll process fosters organizational transparency and trust. Comprehensive information about benefits, compensation policies, and workers comp coverage enhances employee satisfaction and reduces misunderstandings.

Open communication channels allow employees to address concerns, seek clarification, and participate in injury prevention initiatives.

- Partnering with Experts:

Working with industry leaders like insurance brokers and payroll service providers makes this a reality. Practical assistance will be a reward to get this done well.

These consultants drive change by combining industry experience, technical know-how, and regulatory awareness to create a strategic platform through which companies can sail through uncharted waters to optimize processes. Networking and cultivating enduring collaboration provides access to exclusive resources and mentorship.

Conclusion

A well-constructed workplace takes into consideration issues such as workers comp and payroll done right along with other organizational aspects. Thus, these strategies allow for risk control and a culture of effectiveness, compliance, and accountability. Providing good employee management of the workers comp and payroll is beneficial for the company’s financial health and just as much for maintaining the employees’ welfare and satisfaction.